NYC’s skyline is closing 2025 with momentum. Supertalls like 520 Fifth Avenue and 262 Fifth Avenue near completion, and the InterContinental Times Square sold for $230 million—signals that capital and confidence remain strong across commercial, residential, and hospitality.

Yet a new DPR report flags a different 2026 story: skilled labor will be scarce. For privately held, mid-sized contractors that rely on SAGE 300 CRE, this is both a warning and a window of opportunity.

What’s propelling the boom

– 520 Fifth Avenue: An 88-story, mixed-use tower by Kohn Pedersen Fox and Rabina, reaffirming demand for prime Midtown space (https://newyorkyimby.com/2025/12/520-fifth-avenues-exterior-nears-completion-in-midtown-manhattan.html)

– 262 Fifth Avenue: Meganom’s 860-foot residential tower marries ultra-luxury with Passive House design and advanced engineering (https://www.archdaily.com/1037382/meganom-nears-completion-of-262-fifth-avenue-residential-skyscraper-in-new-york-city)

– Hospitality confidence: The InterContinental Times Square trades for $230M, a bet on tourism and events (https://www.bisnow.com/new-york/news/office/intercontinental-times-square-sells-for-230m-the-ny-deal-sheet-december-16-2025/)

The labor cloud on the horizon

DPR forecasts a 2026 skilled labor shortfall as projects rebound across healthcare, residential, and hospitality (https://mcdmag.com/2025/12/dpr-report-labor-shortage-looms-as-construction-rebounds/). Tight labor typically drives wages higher, intensifies competition for foremen and specialty trades, and increases the risk of delays and cost overruns.

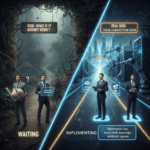

Why mid-sized contractors should act now

– Opportunity: Faster bidders with cleaner workflows will capture work when competitors stumble on staffing.

– Risk: Inaccurate field data, lagging cost forecasts, and sub compliance gaps compound quickly in a tight market.

– Linchpin: SAGE 300 CRE must provide real-time insight into labor, costs, and subcontractor commitments.

2026 success playbook for SAGE 300 CRE shops

– Tighten field-to-office integration: Use digital site logs, automated time capture, and direct SAGE integrations to cut reporting lag and errors.

– Run weekly labor cost scenarios: Model 5–15% wage increases and reprice bids with current data, not last quarter’s averages.

– Monitor subcontractor commitments in real time: Set automated alerts for compliance, insurance expirations, and change orders to prevent stalls.

– Automate what can be automated: Payroll, compliance reporting, and AIA billing should be integrated, auditable, and fast.

– Build your talent network now: Start outreach, prequal, and digital onboarding so you can mobilize quickly.

Frank’s take

Speed, accuracy, and visibility will separate winners in 2026. Use today’s surge to strengthen your SAGE 300 CRE workflows, shore up data quality, and automate routine tasks. The firms that operationalize discipline now will win more work—and finish it profitably.

If you’d like a quick assessment of your SAGE 300 CRE setup and field-to-office workflows, let’s talk. One conversation now can turn a looming labor crunch into your competitive advantage.

References

– Commercial Real Estate News for December 22, 2025 (https://richardplehn.com/commercial-real-estate-news-for-december-22-2025/)

– Additional sources linked above.