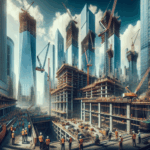

Three developments just sent a clear message to NYC’s construction community: opportunity is growing, but so are expectations.

1) Brookfield’s $1.5B lease extension at Brookfield Place

Brookfield Properties extended the ground lease for Brookfield Place with the Battery Park City Authority, marking a long-term, high-confidence commitment to Lower Manhattan. The five-tower, mixed-use campus anchors a significant share of the downtown office market and draws blue-chip tenants.

Why it matters:

– Market confidence returns to core office locations, supporting steady demand for upgrades, amenities, and tenant improvements.

– Big tenants expect smarter, more connected spaces, raising the bar for integrated construction and technology delivery.

– For contractors, this points to sustained opportunities in capital improvements, fit-outs, and ongoing service agreements.

2) JRM’s retail wins: Reformation and Lacoste flagships

JRM completed a 2,770-square-foot Reformation store and a flagship for Lacoste, signaling that premium retail is investing in NYC’s top corridors.

Why it matters:

– Retail isn’t dead; it’s premium. High-end brands continue to fund immersive, tech-enabled, and sustainable stores.

– These projects demand custom millwork, rapid schedules, precise coordination, and airtight quality control.

– Firms that manage scope shifts and integrate technology will protect margins and meet brand standards.

3) Insurance shift: ALKEME acquires Alliance Brokerage

ALKEME’s purchase of NYC-based Alliance Brokerage expands construction-centric risk expertise, a timely development as underwriting tightens and project stakeholders raise requirements.

Why it matters:

– NYC construction risk is complex, spanning safety, compliance, weather, supply chains, and cyber.

– National scale plus local know-how can improve coverage options, claims support, and pricing outcomes.

– Lenders and owners increasingly expect robust documentation, certificates, and incident workflows tied to finance.

What NYC contractors should do now

– Tighten cost and schedule control: Strengthen change order discipline, field-to-office reporting, and real-time visibility so surprises don’t become write-offs.

– Modernize compliance and risk: Keep insurance certificates, safety logs, and incident reports synchronized with project accounting to meet lender and owner requirements.

– Integrate systems around Sage 300 CRE: Connect estimating, project management, field capture, and accounting to reduce errors, speed billing, and improve forecasting.

Bottom line

From billion-dollar office commitments to premium retail investments and insurance consolidation, the work is there for firms organized enough to capture it. Treat Sage 300 CRE as your operational command center: integrate your workflows, prove compliance, and deliver on time and on budget.

Source: Commercial Real Estate Direct (crenews.com)