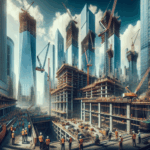

Breaking news for NYC construction: CounterpointeSRE has closed a record-setting $156 million Commercial Property Assessed Clean Energy (C-PACE) financing to help deliver Echelon Studios in Brooklyn. The full development totals $304 million and will bring 10 energy-efficient sound stages to the borough. The project is led by a joint venture of Bain Capital Real Estate and Bungalow Projects, with Eastdil Secured and Farallon Capital Management arranging the broader financing.

What happened

New York City just landed its largest single C-PACE financing to date. The funds will support two state-of-the-art, sustainability-forward film production facilities designed by COOKFOX Architects. The project’s focus on energy performance and low-carbon strategies makes it a national benchmark for green building in media infrastructure.

Why it matters for NYC contractors

For privately held contractors in the 30–200 employee range—especially those running Sage 300 CRE—this is more than headline news. It signals where opportunity is moving:

– Sustainable construction is the new baseline. Owners and lenders increasingly tie funding to measurable energy performance and ESG outcomes.

– Innovative financing like C-PACE is unlocking large projects by reducing upfront capital strain and aligning repayment with long-term savings.

– A sophisticated back office wins work. Complex financing requires airtight controls, cost tracking, and reporting. Firms with well-configured Sage 300 CRE stacks are better positioned for compliance and execution.

Echelon Studios at a glance

– Scope: Two film production facilities totaling 10 sound stages in Brooklyn

– Design priorities: Minimized energy consumption, advanced HVAC systems, superior insulation, potential renewable integrations, and lower carbon footprint

– Financing: $156M in C-PACE within a $304M capital stack involving institutional players

C-PACE 101: Why owners, lenders, and cities like it

C-PACE lets property owners fund energy-saving improvements through a special assessment tied to the property. Key advantages include:

– Long tenors and property-based repayment lower risk and smooth cash flows

– Eligibility for a wide range of measures, from building envelope to mechanical systems and solar

– Compatibility with construction loans, freeing capital for core scope while advancing sustainability goals

Implications for mid-sized NYC contractors

1) Studio construction surge: Streaming demand and post-COVID shifts are fueling studio builds. Contractors with logistical, climate-controlled, and MEP-intensive experience are well positioned.

2) Green drives funding: Lenders expect credible energy modeling, commissioning, and measured results. Demonstrable sustainability chops improve win rates and margins.

3) Back-office excellence: Lenders and owners want traceability. If you can produce clean draw schedules, energy reporting, and cost segregation on demand, you reduce friction and risk.

4) Brooklyn as a case study: Success here will influence similar projects nationwide. Perform well and doors open beyond NYC.

Action plan for Sage 300 CRE shops

– Evaluate your tech stack: Confirm your system can handle C-PACE workflows, multi-tranche draws, retainage nuances, and energy reporting data.

– Integrate project controls: Connect field tools (RFIs, submittals, change orders) with accounting to keep schedules, budgets, and compliance aligned.

– Build a green project portfolio: Document LEED, Passive House, high-performance envelope, and electrification work. Package it for proposals.

– Standardize energy documentation: Create templates for audits, commissioning, M&V data, and lender-ready cost breakdowns.

– Train for financing fluency: Educate PMs and accounting on C-PACE mechanics, lien position, and reporting cadence to de-risk execution.

– Tighten cash management: Use Sage 300 CRE to forecast draws, monitor contingencies, and align subcontractor pay apps with lender milestones.

The bottom line

C-PACE-backed, energy-smart projects are not a passing trend—they are reshaping who wins work and why. Firms that invest in sustainability capabilities and back-office rigor will outcompete on complex, well-capitalized builds like Echelon Studios. If your systems and processes are not ready, now is the time to level up.

Source

BusinessWire: https://www.businesswire.com/news/home/20251006592574/en/CounterpointeSRE-Closes-Record-Breaking-$156-Million-C-PACE-Financing-for-Echelon-Studios-New-York-City-Production-Studio-Portfolio